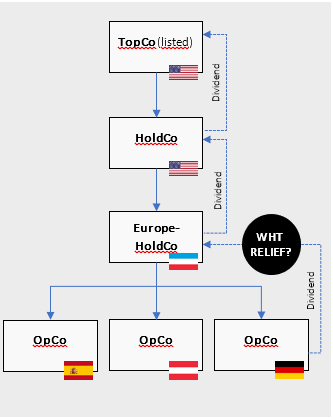

The relief from withholding taxes (WHT) is an important parameter for corporate structures and tax planning of multinational enterprises investing into Germany. Currently, they can claim relief from WHT levied on dividends or licence payments based on a tax treaty or an EU directive subject to the German anti-treaty shopping provision. A legislative process is underway to adjust this provision, considering recent developments in international and European tax law.

The amendment, if passed as currently proposed, may have substantial adverse implications for US multinationals investing into Germany via interim (holding) entities or granting licences likely by requiring an active management business of such holding or IP entity. A potential need either to reorganize such existing structures or to at least ensure proper documentation of sufficient activity should be assessed at an early stage based on the ongoing legislative process.

The proposal is expected to be endorsed on 20 January by the German Government. This will be the first formal step in the legislative process. Normally such drafts are basically adopted by the parliament as proposed.

Current situation

Subject to certain requirements, dividends and licences paid from a Germany subsidiary to its (direct) listed US parent are currently (fully) exempt from German WHT under the German/US tax treaty. According to the current rules and administrative practice, this also holds true if entities, eg resident in common holding jurisdictions such as Luxembourg or the Netherlands, are interposed between the US parent (or a subsidiary) and the German sub.

The interim structure is currently (rightly) not deemed abusive since a direct investment into Germany would also be feasible without any WHT exposure.

Consequences of legislative proposal

According to the current legislative proposal relief from German WHT may not be granted anymore in such described structure.

Unlike today, the fact that the US/German treaty provides for full WHT relief (under certain circum-stances) would no longer exclude the application of the anti-treaty shopping rule. In contrast, in case of an interposed passive financial holding entity, it would be asked whether the main or one of the main purpose(s) of this interposition is obtaining a (not necessarily WHT) tax advantage (which may be difficult to refute in case of jurisdictions such as Luxembourg or the Netherlands with quite favourable tax regimes).

In addition, the fact that the ultimate parent company is listed, does not per se lead to a WHT relief.

If the proposal were adapted, it is to be feared that only interposed entities with an active business (such as management holdings actively and strategically managing its portfolio or fully operating companies) to which the German sub can be attributed, remain eligible for German WHT relief.

It remains to be seen whether the proposal will still be changed and/or how it would be interpreted in detail. However, the current direction to put further constraints on WHT relief in Germany is quite obvious. Possibilities to mitigate potential adverse effects should however be explored early on.

If you would like to discuss this further, please reach out to any of us directly or approach your usual Freshfields contact.

/Passle/5832ca6d3d94760e8057a1b6/MediaLibrary/Images/5caf47f7abdfea0b306b985f/2021-08-16-10-10-30-866-611a3996400fb311c899dbf1.jpg)