The year started with a surprise for several associations of the German financial industry as they were informed by BaFin and Bundesbank by e-mail of new requirements regarding investments in “special funds” (Spezialfonds). The e-mail comes after a lengthy debate that was initiated as early as 2021 by a proposal of BaFin and Bundesbank and that was subsequently accompanied by discussions in BaFin’s expert panel (Fachgremium) on the Minimum Requirements for Risk Management (Mindestanforderungen an das Risikomanagement, MaRisk) on 2 September 2021 as well as by a joint statement of the German Banking Industry Committee (Deutsche Kreditwirtschaft) and the German Investment Funds Association (BVI) on 24 September 2021. After the discussion had paused for some time, a compromise seemed to have been found at the end of 2022 that would have - at least partially - considered the interests of the German financial industry. However, the e-mail of 3 January 2023, which seems to reflect the regulators’ final position just a few months after BaFin has published its latest consultation on MaRisk amendments (for an overview on these amendments, see our recent blogpost) seems to call this compromise into question.

Issue at stake

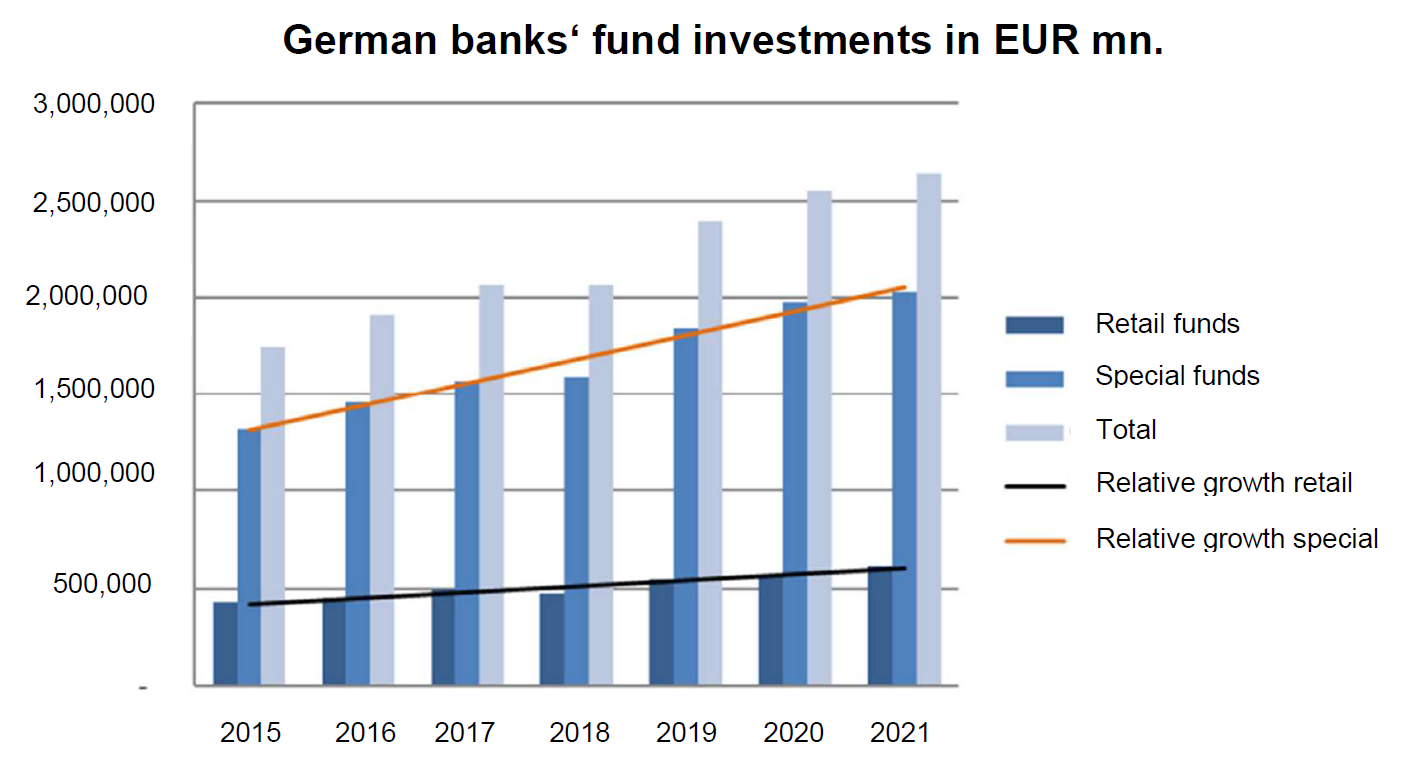

In their search for higher yields in an – until recently – persistently low interest rate environment, German banks have increasingly relied on investments in fund structures in recent years. According to Bundesbank statistics, investments by banks in the special fund sector grew by 54 % since 2015:

Source: Bundesbank

The Bundesbank figures also show that special fund investments are particularly widespread among German savings banks (Sparkassen), making up on average over 5 % of their balance sheet totals in 2020.

According to BaFin and Bundesbank, such special fund investments have raised concerns as to the compliance with MaRisk requirements on risk analysis, voting and limits because the individual transactions at the level of the special fund would be a ‘blind spot’. While banks’ credit business (Kreditgeschäft) and trading business (Handelsgeschäft) - including investments into special funds - are subject to independent voting requirements under MaRisk, there would be no comparable requirements for transactions of special funds held by banks. Regulators, therefore, feared a circumvention of MaRisk requirements in cases where investments into special funds exceeded 5 % of a bank’s balance sheet total. The German financial industry, on the other hand, pointed to the fact that the management companies are also supervised undertakings that have their own risk management and that it is their responsibility to ensure that the risks of the assets acquired by the special funds are identified and properly managed on an ongoing basis.

New expectations regarding special fund investments

Against this background, BaFin and Bundesbank have now expressed the expectation that individual positions held by special funds that exceed certain thresholds will be taken into account and monitored in a bank’s individual limit system.

Insofar as the share of total special fund investments in the balance sheet total exceeds 5 %, banks are therefore expected to comply with the following:

- All limits that banks have set for direct investments by taking into account the MaRisk requirements for credit procedures (i.e., individual limits and institution specific global limits) must also be applied to exposures held by special funds. Banks’ trading business (Handelsgeschäft) limits will, therefore, need to be applied to underlying positions of special funds as well.

- This monitoring only applies to those exposure values that exceed the institution-specific risk relevance limit (Risikorelevanzgrenze) for their credit business. The term "risk relevance limit" refers to BTO 1.1 no. 4 MaRisk, which requires institutions to differentiate between risk relevant (risikorelevantes) and non-risk-relevant credit business (nicht-risikorelevantes Kreditgeschäfte). In this context, the BaFin considers it appropriate for institutions to use de minimis thresholds (Bagatellgrenzen) against which they review whether an individual transaction is to be classified as non-relevant credit business. Underlying positions of special funds that fall below this de minimis threshold can therefore be disregarded.

- Compliance of the individual underlying positions of the special funds with the relevant limits must be monitored at least quarterly. Where the underlying positions are not already monitored, banks’ limit system will, therefore, need to be expanded to also oversee underlying positions. Banks that hold their own investments exclusively through special funds and do not engage in direct investment business still have to set up a corresponding limit system.

- In the event that these issuer or global limits are exceeded, countermeasures must be initiated by the next regular monitoring interval at the latest.

These new requirements complement the existing prudential requirements on both the calculation of own funds requirements for exposures in the form of units or shares in collective investment undertakings in accordance with Article 132 and 132a of Regulation (EU) No 575/2013 (CRR) and the calculation of exposure values for purposes of compliance with the large exposure limits in accordance with Article 390(7) CRR and Delegated Regulation (EU) No 1187/2014, which – in principle – require institutions to look-through onto the underlying assets, provided they have sufficient information for doing so.

However, for the avoidance of doubt, BaFin only expands the scope of MaRisk requirements in this respect. The due diligence requirements of § 18 KWG still only apply to the special fund itself and not to the underlying investments.

While BaFin’s expectations may result in additional administrative burden for banks, it seems that the regulators have taken at least some of the industry’s concerns raised in the aftermath of the September 2021 discussions into account. The regulators had initially proposed that a bank should carry out a risk assessment and vote (with first and second vote) for individual positions held via special funds. For the first vote, outsourcing agreements were to be drawn up with the fund’s management company. However, decision-making powers of third parties such as investors within the scope of a first and second vote are inadmissible under investment law according to the AIFMD and the German KAGB. This no longer seems to be a requirement.

Open questions

Nonetheless, BaFin’s and Bundesbank’s email of 3 January 2023 leave many questions unanswered. Some of the most pressing questions are the following:

- The wording of BaFin’s and Bundesbank’s e-mail seems to suggest that the expectations apply as of the date of the e-mail and without any phase-in periods. However, neither of the two competent authorities has yet published this expectation via their website. It seems unclear whether the expectations will be officially included in the MaRisk or not. This also raises the question of whether the banks’ auditors will need to assess compliance with this new expectation.

- It is unclear whether investments in special funds are also covered by the regulators' expectations if the management company guarantees that the value of the investment in the special fonds will not fall below a certain minimum amount (so-called "minimum value commitment").

- The calculation of the 5 % of the balance sheet total-threshold is not yet fully clear. Exposures to special funds may include both balance sheet items (ie, the participation in the special fund) as well as off-balance sheet items, such as undrawn capital commitments.

- It is also unclear, whether and how banks should apply their risk relevance limits (Risikorelevanzgrenze) to underlying positions of the special funds that consists of tangible assets (such as land, aircraft, ships and wind turbines) or fully collateralised exposures.

- Moreover, the competent authorities have not yet specified what the term ‘special funds’ is supposed to comprise. While it seems likely that the term refers to Spezial-AIF in the terminology of the German Investment Code (Kapitalanlagegesetzbuch) irrespective of the seat of the special fund, it is not entirely clear whether the requirement would also apply to structures that do not qualify as Spezial-AIF, in particular in the real estate and shipping industries. UCITS are, however, not captured by the new requirement.

- In addition, it is not clear whether all Spezial-AIF are supposed to be captured by this new requirement or whether certain Spezial-AIF are excluded. BaFin has, for example, only recently introduced requirements for banks’ real estate business in a new section BTO 3 of the MaRisk (see our blogpost [Link] on this aspect), which raises the question of whether real estate funds are supposed to be captured by the new expectation on special fund investments and, if so, how these new expectations are to be applied to such funds. It also remains unclear how the new requirements are to be applied to fund-of-funds structures.

- BaFin and Bundesbank have not specified what countermeasures are expected of a bank once the issuer or global limits are exceeded, in particular since a reduction of the exposure to a specific fund will generally only be possible within the remits of the partnership agreement. Further, as investors in a fund, banks will typically not have any power to direct the investment management company to reduce the exposure to a specific underlying position. Banks will, therefore, need to consider appropriate countermeasures that might include, e.g. the entering into hedge agreements in relation to a specific underlying exposure. At least in fund-of-one structures, banks might also consider reflecting the issuer and global limits in the investment strategy of a special fund or – where possible under investment law – recommending to the management company to reduce the exposure to an underlying. A possible countermeasure also seems to be the raising of a limit, which would require undergoing MaRisk compliant voting processes.

Overall, the regulators’ new expectations on special fund investments seem to be a certain compromise compared to the initial proposals from September 2021, considering investment law principles. However, the e-mail dated 3 January 2023 still leaves many questions unanswered which need to be addressed in order to make the new expectations operational.

/Passle/5832ca6d3d94760e8057a1b6/MediaLibrary/Images/2026-02-18-10-29-54-627-699594a29c19591623162309.jpg)

/Passle/5832ca6d3d94760e8057a1b6/MediaLibrary/Images/2026-02-19-10-01-26-074-6996df76e26d413e4916fa52.png)