Earlier this week, the OECD released its annual set of statistics on the use of the mutual agreement procedure (MAP) in 2022. According to the commentary published alongside the figures, four key trends can be seen in this data. Building on the overview of MAP in our Tax investigations and disputes across borders guide, we explore those (purported) trends in this blog post.

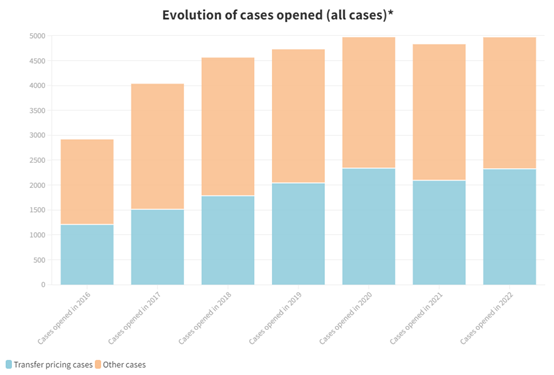

‘Taxpayers are engaging with MAP more than ever’

Almost 5,000 new MAP cases were opened in 2022.

The OECD notes that this figure is up by almost 3 per cent. on the year before, showing that taxpayers ‘have increasing faith in MAP owing to greater availability and access’.

However, a look at the bigger picture suggests a plateau here – gone are the large annual increases seen immediately following the release of the BEPS Action 14 Final Report; instead, the number of new MAP cases being opened each year appears to have largely stabilised, and the increase in 2022 follows a dip in 2021.

Source: OECD

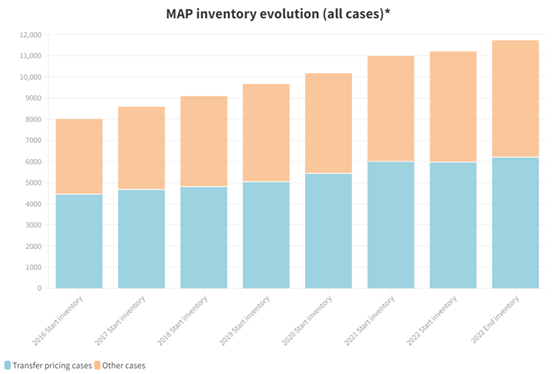

‘Fewer MAP cases were closed in 2022’

Approximately 4 per cent. fewer MAP cases were closed in 2022 than the year before, with this trend particularly acute in relation to non-transfer pricing cases.

The OECD notes that, rather than being a negative trend, this is ‘a return to baseline’ following a ‘stellar year’ for MAP case closures in 2021 in which many competent authorities prioritised closing simpler cases, and is still a marked improvement on the figures for earlier years.

That is true, but drawing such a conclusion from the figures perhaps masks a more troubling undercurrent: the number of MAP cases being opened continues to exceed the number of MAP cases being closed, resulting in an ever-increasing backlog. Even Luxembourg, recognised for its excellent caseload management at the 2022 MAP Awards, had a larger inventory at the end of 2022 than it did at the start.

With competent authorities’ budgets stretched – and that being unlikely to change in the foreseeable future, given adverse macroenvironment headwinds and a growing list of competing priorities in the international tax space (not least the impending introduction of Pillar Two reforms) – one might wonder how this gap will be closed.

Source: OECD

‘Outcomes remain generally positive’

The headline figures given by the OECD are that around 73 per cent. of MAPs concluded in 2022 ‘fully resolved the issue’ and only 2 per cent. of MAPs were closed ‘with no agreement’.

There is some nuance in the underlying data here, though. Only 59 per cent. of closed cases involved an agreement being reached which fully eliminated the double taxation and/or fully resolved the issue of taxation not in accordance with the relevant treaty. The cases falling within the 14 per cent. delta were instead resolved via domestic remedy or unilateral relief, which suggests that MAP did not necessarily result in full agreement as between the competent authorities involved. Moreover, in 9 per cent. of cases, the taxpayer withdrew from the MAP – and one might wonder whether, at least in some of those cases, that was because the likelihood of successful resolution was seen as being low.

Source: OECD

Taking a closer look at the jurisdiction-by-jurisdiction data, other interesting points emerge. For example, almost 80 per cent. of MAPs involving the UK concluded in 2022 were ‘fully resolved’ (taking the OECD’s broad definition of this phrase) – materially above the worldwide average. However, MAPs involving the UK concluded in 2022 were markedly more likely to be resolved via unilateral relief than the worldwide average – with this difference particularly acute in relation to transfer pricing cases (8 per cent. against 2 per cent.).

‘Average case times start to close in on the 24-month target’

MAP cases closed in 2022 had been open for an average of 25.3 months. Whilst still longer than the 24-month target, it is an improvement on previous years’ figures.

But again, the devil is in the detail. Transfer pricing cases continue to take longer to resolve than other cases (28.9 months against 22.17 months, on average), but that varies significantly as between different jurisdictions. Of the jurisdictions that closed more than 50 transfer pricing MAP cases in 2022, the Netherlands boasted the shortest average time of ‘just’ 19.62 months. 13 less-active jurisdictions were even faster. At the other end of the spectrum, six jurisdictions took an average of over 40 months to close transfer pricing MAP cases, notably including the US (at 42.88 months) and India (at 48.97 months). Slovenia, which only closed 2 transfer pricing MAP cases in 2022, tops the list with an average of 63.06 months.

The OECD notes that these improving case times is a ‘positive’ development, but that ‘there is more work to be done’ in this respect. Few businesses who have engaged in this (imperfect and sometimes opaque) process would disagree with that statement – but whether it is realistic to expect that competent authorities will have the resources to materially accelerate the resolution of transfer pricing MAPs remains to be seen.

Reflecting on the statistics as a whole, perhaps the biggest takeaway is simply this: another year of slow and steady progress, but questions remain about the longer-term sustainability of an ever-increasing MAP caseload.

If you would like to discuss any of the points raised in this blog post in further detail, please contact the authors, our tax investigations and disputes team or your usual Freshfields contact.

/Passle/5832ca6d3d94760e8057a1b6/MediaLibrary/Images/2026-02-18-10-29-54-627-699594a29c19591623162309.jpg)

/Passle/5832ca6d3d94760e8057a1b6/MediaLibrary/Images/2026-02-19-10-01-26-074-6996df76e26d413e4916fa52.png)