In an early indication of an area where UK financial services regulation may diverge from the EU once the Brexit transition period ends, Sam Woods, Deputy Governor for Prudential Regulation, Bank of England and CEO, PRA, has given a speech setting out how capital requirements might be simplified in order to increase dynamism in the UK banking sector.

The idea is not new – back in 2014 the Bank of England lobbied for an easing of global capital requirements for small banks soon after Basel III was implemented. The Bank’s response to the European Commission’s public consultation on the possible impact of the CRR and CRD IV on bank financing of the economy suggested that the one size fits all EU standards would not lead to a level playing field and effective competition, as the costs of meeting regulation bear more heavily on smaller banks.

The UK can also look to jurisdictions like Switzerland and Australia to see how similar regimes have fared.

Mr Woods has highlighted three guiding “lodestars” of the UK regime: high regulatory standards, responsible openness and dynamism. Focusing on dynamism, Mr Woods was hopeful about the steps that the UK will be able to take, following Brexit to put in place “rules made by regulators, rather than set out in law” – which could allow for a timely, flexible, and proportional approach.

The current prudential regime applies the “full weight of regulation to firms of all sizes”. Although it achieves the aim of harmonisation across the EU single market, it leads to the proportionality problem. The “costs of understanding, interpreting and operationalising prudential requirements” are proportionally higher for smaller firms, which leads to barriers to growth.

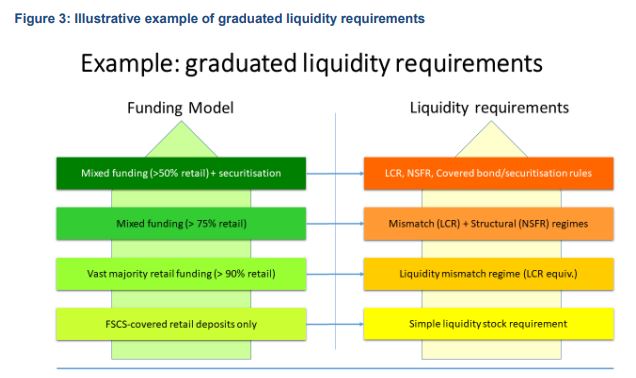

Mr Woods noted that the PRA is looking at the introduction of a graduated regime where banks can migrate from a very simple regime, in the initial stages of development, up through a series of steps towards the full Basel-based regime as they become larger or involved in more complex activities. However, as with any well-intentioned rule, it is hard to predict how it will impact behaviour.

[Figure 3 - image source]

[Figure 3 - image source]Will banks use this as an opportunity to move up through the regime and be as dynamic as Mr Woods hopes? Or will it create incentives to remain at a certain size in order to stay within a lighter capital regime? Similar sorts of behaviour have already been seen with banks seeking to stay below the threshold at which they would need to comply with the UK’s ring-fencing requirements.

One thing is for sure, this will not be the only area where UK financial services regulation starts to diverge from the EU in the next few years. The Treasury is already consulting much more widely on the future of financial services in the UK.